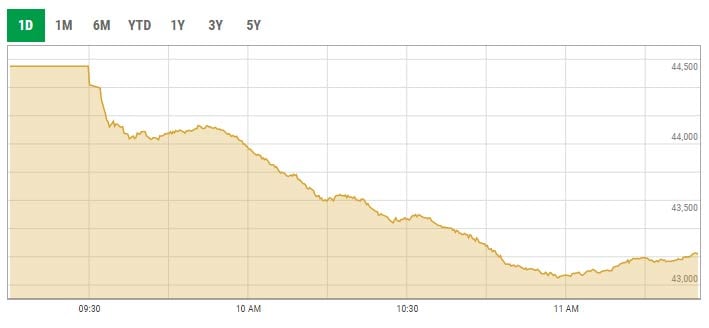

KARACHI: The Pakistan Stock Exchange (PSX) took a hammering on Monday and the benchmark KSE-100 index dived nearly 1,500 points in intra-day trading at one point as the rising oil prices amid geopolitical tensions shattered investor confidence.

The KSE-100 – a benchmark for market performance – underwent selling pressure from the word go, falling below the 44,000-point mark during intra-day with volumes remaining on the lower side.

The market was trading at 43,217.55 at 11:24 am down 1,333.8 points or 2.99%.

Market talk suggested that the uncertainty in international markets is the prime reason behind investors’ dump-and-run approach at the PSX.

BMA Capital Executive Director Saad Hashemy said that the market was primarily down because of rising oil prices in the international market.

“The oil was the last trading at $115 per barrel on Friday; however, the prices surged by $15 on Monday morning which impacted the financial markets worldwide,” he said.

Oil prices soared more than 9%, touching their highest since 2008, as the United States and European allies mull a Russian oil import ban and delays in the potential return of Iranian crude to global markets fuelled tight supply fears.

Meanwhile, gold prices scaled the $2,000-level for the first time in a year-and-a-half, as investors rushed to the safety of the metal in the wake of an escalating Russia-Ukraine crisis, while supply disruption fears sent palladium to an all-time high.

The analyst further added that the local market players are concerned about the impact of rising oil prices on the current account deficit.

“Till uncertainty prevails and the global markets remain in panic mode, investors will avoid taking fresh positions,” Hashemy said.

Shedding light on the monetary policy announcement due tomorrow, he said that the market is expecting the State Bank of Pakistan to maintain a status quo; however, if the rate is increased the market will react negatively.

The index has been under immense pressure since the start of the Ukraine-Russia conflict; moreover, the news that the Opposition has intensified their efforts to bring a no-confidence motion against Prime Minister Imran Khan was also seen as a negative for stock market investors.

Analysts expect that the stock market is likely to remain under pressure unless clarity emerges on the oil front.